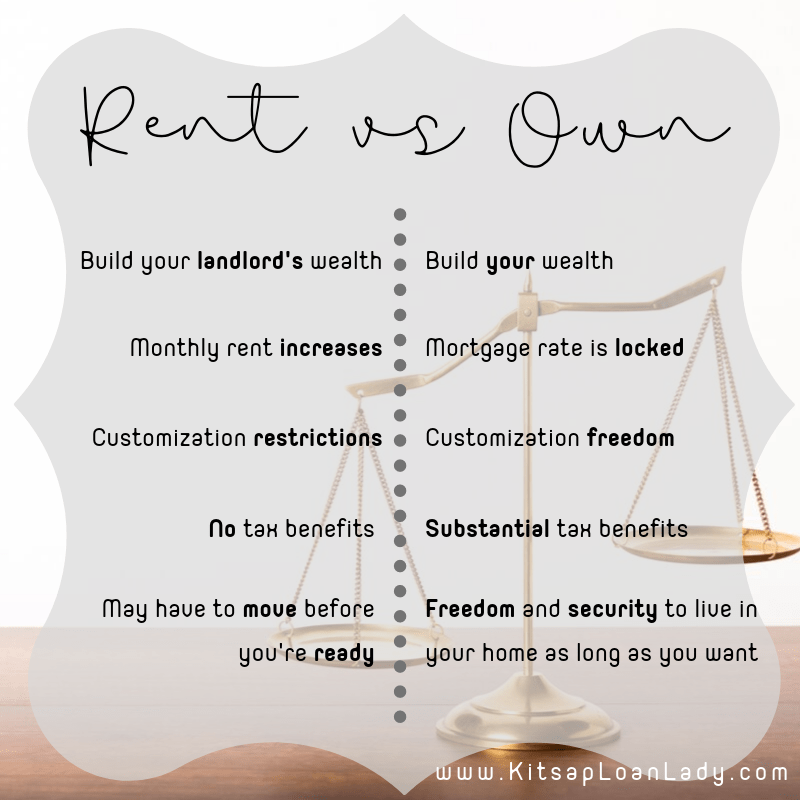

Wealth Building

If you’re renting, then most likely you are either paying your landlord’s mortgage or if your landlord doesn’t have a mortgage you are putting money in your landlord’s pocket every month, which helps increase your landlord’s wealth. If you own your home, you are increasing your wealth with every mortgage payment that you make by reducing the amount you owe on your home loan. In a market where home values are increasing, the combination of decreasing the amount that you owe while the value of your property is increasing can have a substantial impact on your overall net worth.

Monthly Payments

As a renter, once your lease is up (or you are in a month-to-month lease), your landlord has the freedom to increase the amount you are being charged for rent. As a home owner with a fixed rate mortgage, your interest rate is locked and your monthly principal & interest payment can’t change for the life of your loan.

Freedom of Expression

Do you want a green bedroom or a burgundy accent wall in your living room? You can choose your paint colors and remodel endlessly without asking permission when you own your own home!

Tax Time

The mortgage interest that you pay on your home loan as well as certain other expenses related to home ownership can be tax deductible, which is an immediate financial benefit to you. Please be sure to consult with a tax expert about which items are tax deductible and how they impact your tax filing.

Staying Where You Are

Once your lease is up, or if you are in a month-to-month lease, your landlord can give you notice at any time that you need to move. It doesn’t matter if they want to sell the house, move back into it, or rent it to someone else. If they decide you can’t live there anymore, then you may have to move before you are ready (even if you have always paid your rent on time). When you own your home, as long as you make your mortgage payments on time, you can live there until you decide it’s time to move. You might even be able to leave it to your heirs if that’s what you decide to do!